Business Credit Card Application

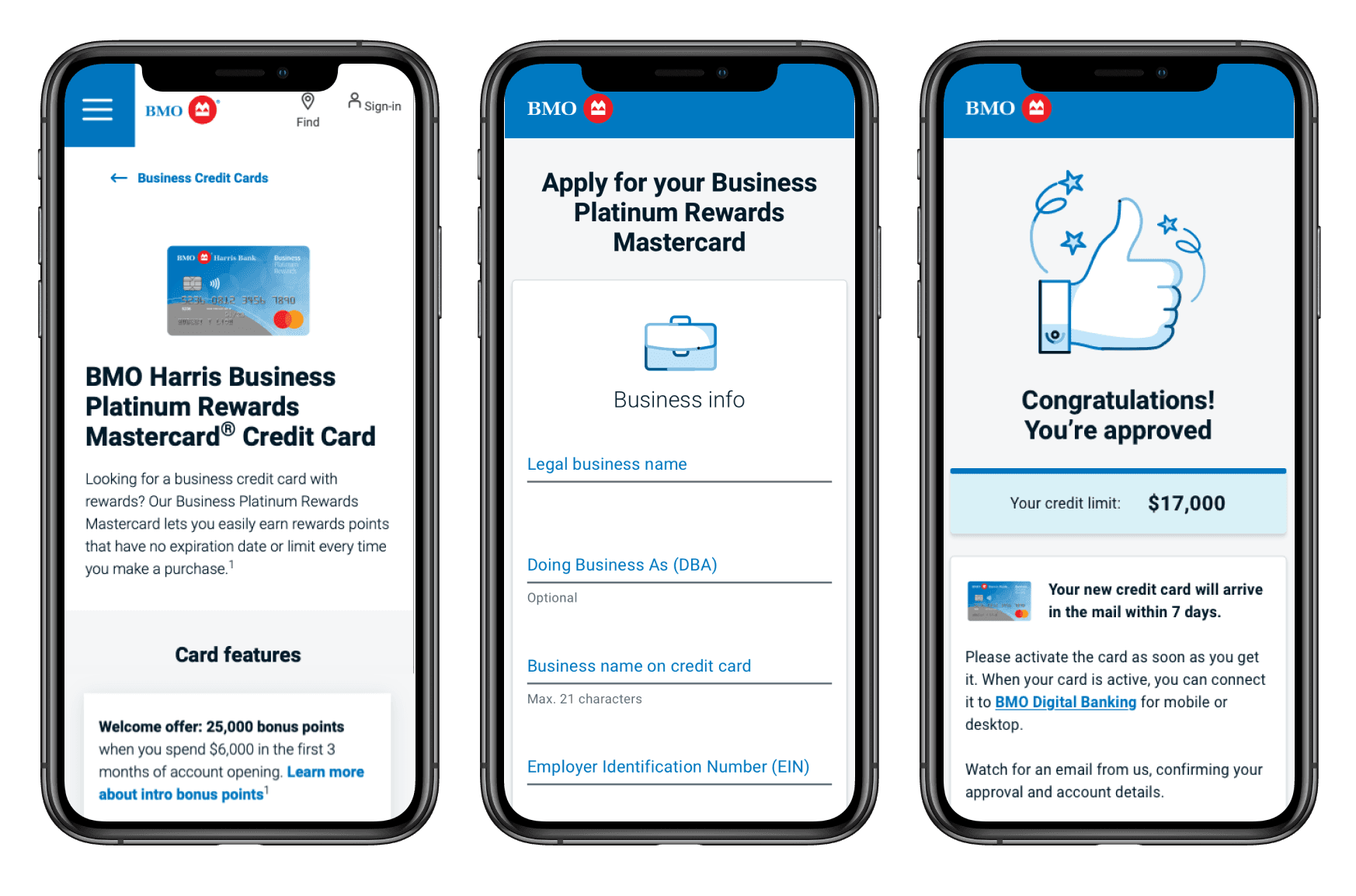

I designed and launched BMO's first online credit card application.

My role

Product designer

Duration

2020-2021

Platform

Web

Team

Product, engineering, business analysts, research, content, legal, marketing

Project goals

Create a consumer-facing application using the in-branch application's backend system

Design an application that can be completed in five minutes or less

Create a dynamic application that can be used across products

The challenge

Who were we targeting?

👤

Small business owners

🇺🇸

US citizens, 18+ years old

📑

Corporation (S or C), sole prop, or LLC

📈

Revenue cannot exceed $10 million per year

How might we design a seamless application experience that customers can complete in five minutes or less?

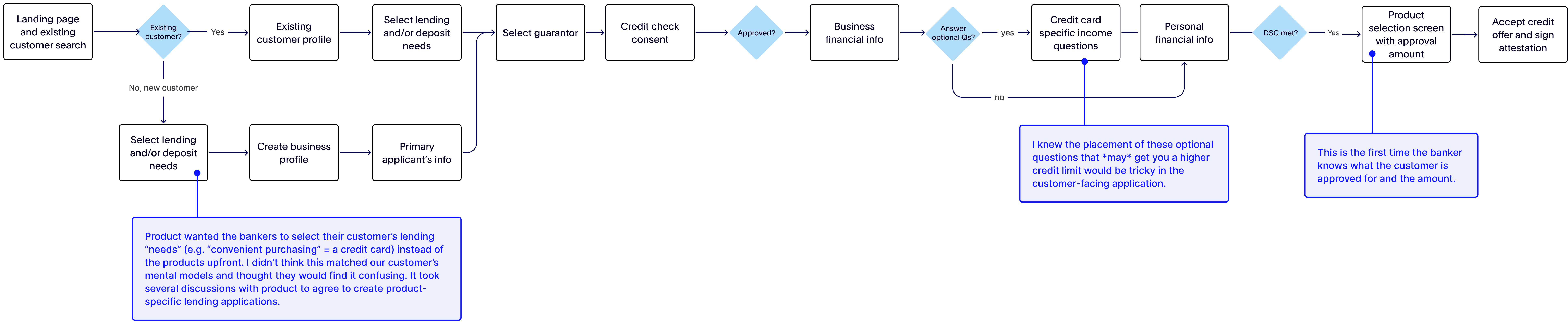

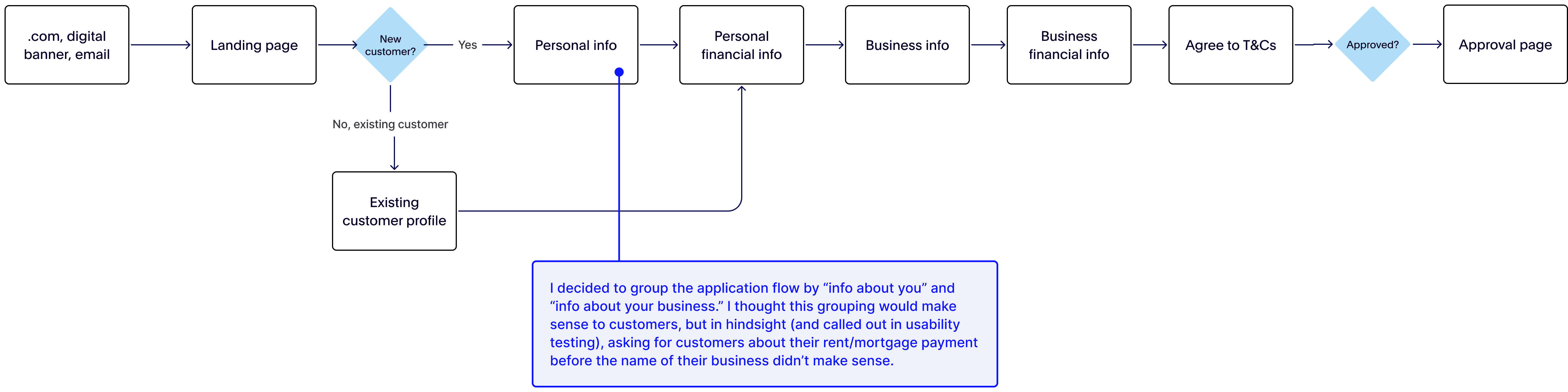

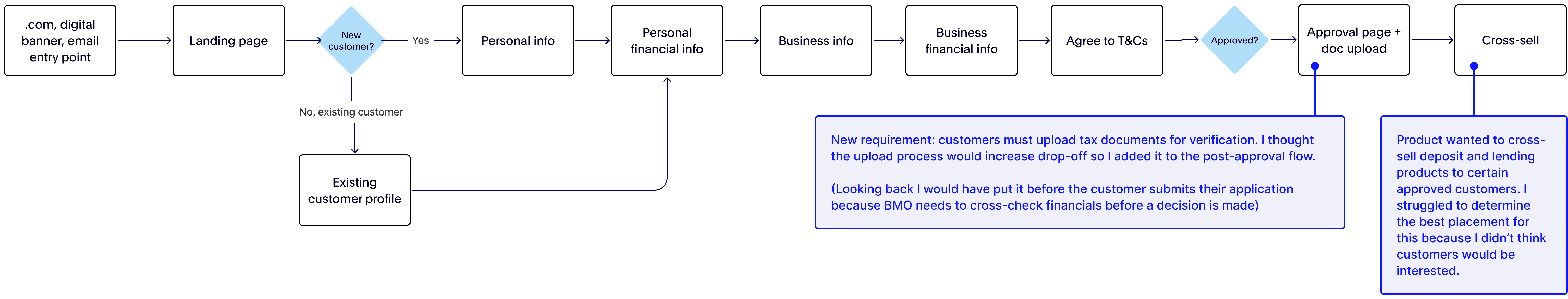

Building the happy path flow

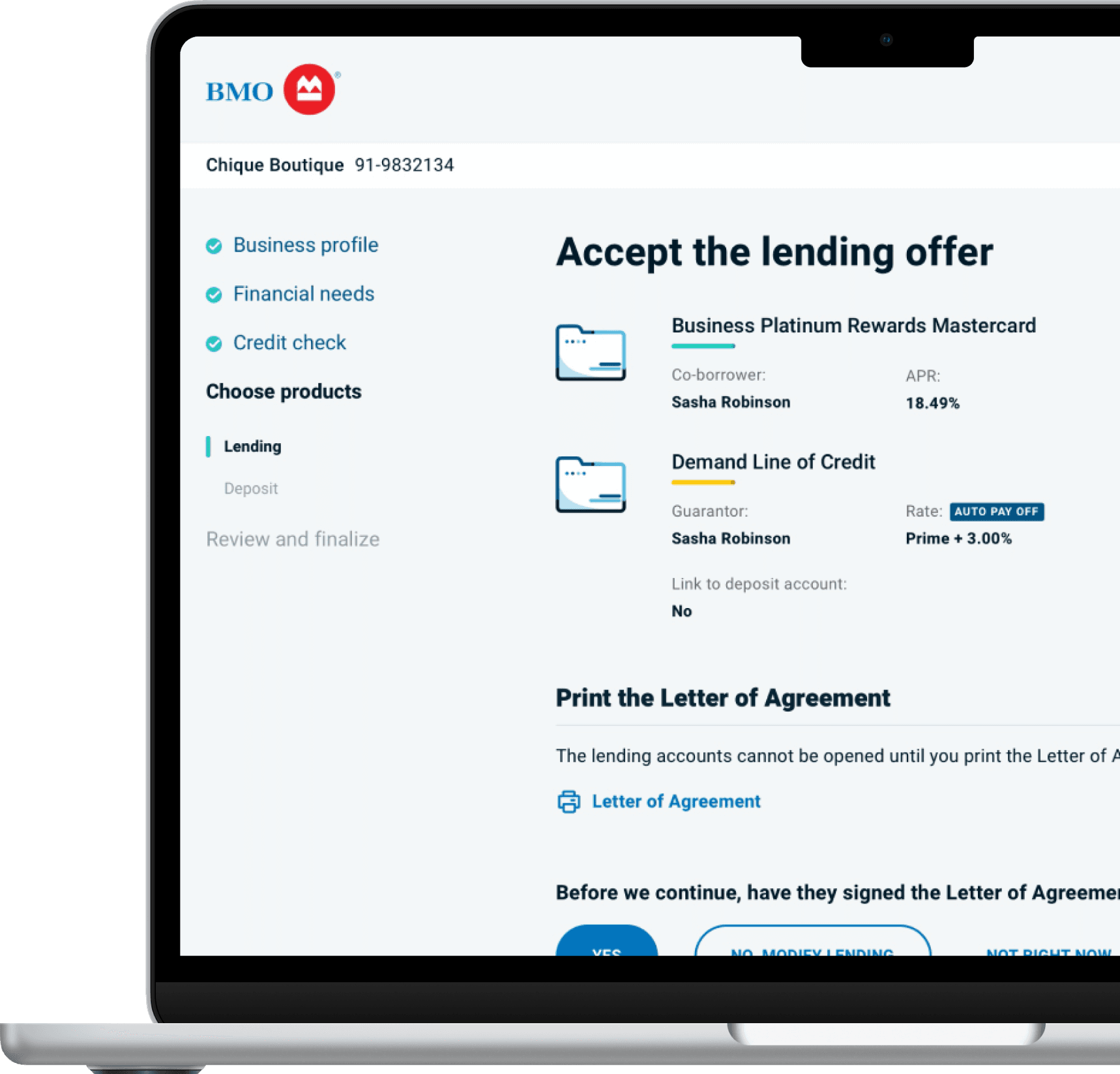

The in-branch BBX credit card application flow

Credit card happy path flow

Updates after reviewing with product

Wireframes

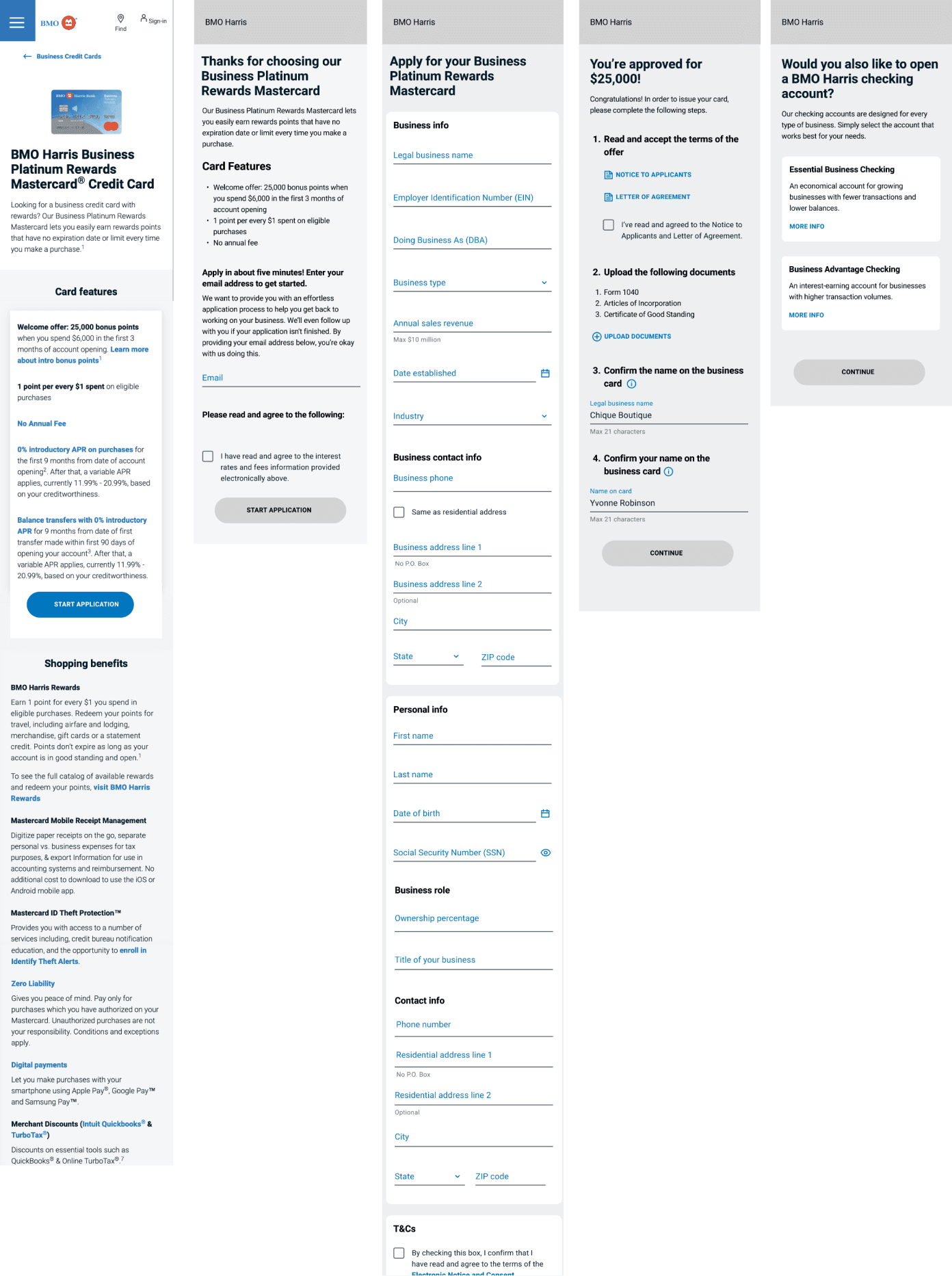

A one page application

During a competitive audit I noticed most of BMO's competitors have one page business credit card applications. I thought a one page application could give the customers a better idea of what to expect, but wasn't sure how well it would work with dynamic questions and error handling.

I put business info before personal info here—clearly I wasn't convinced of my own choice 🤣

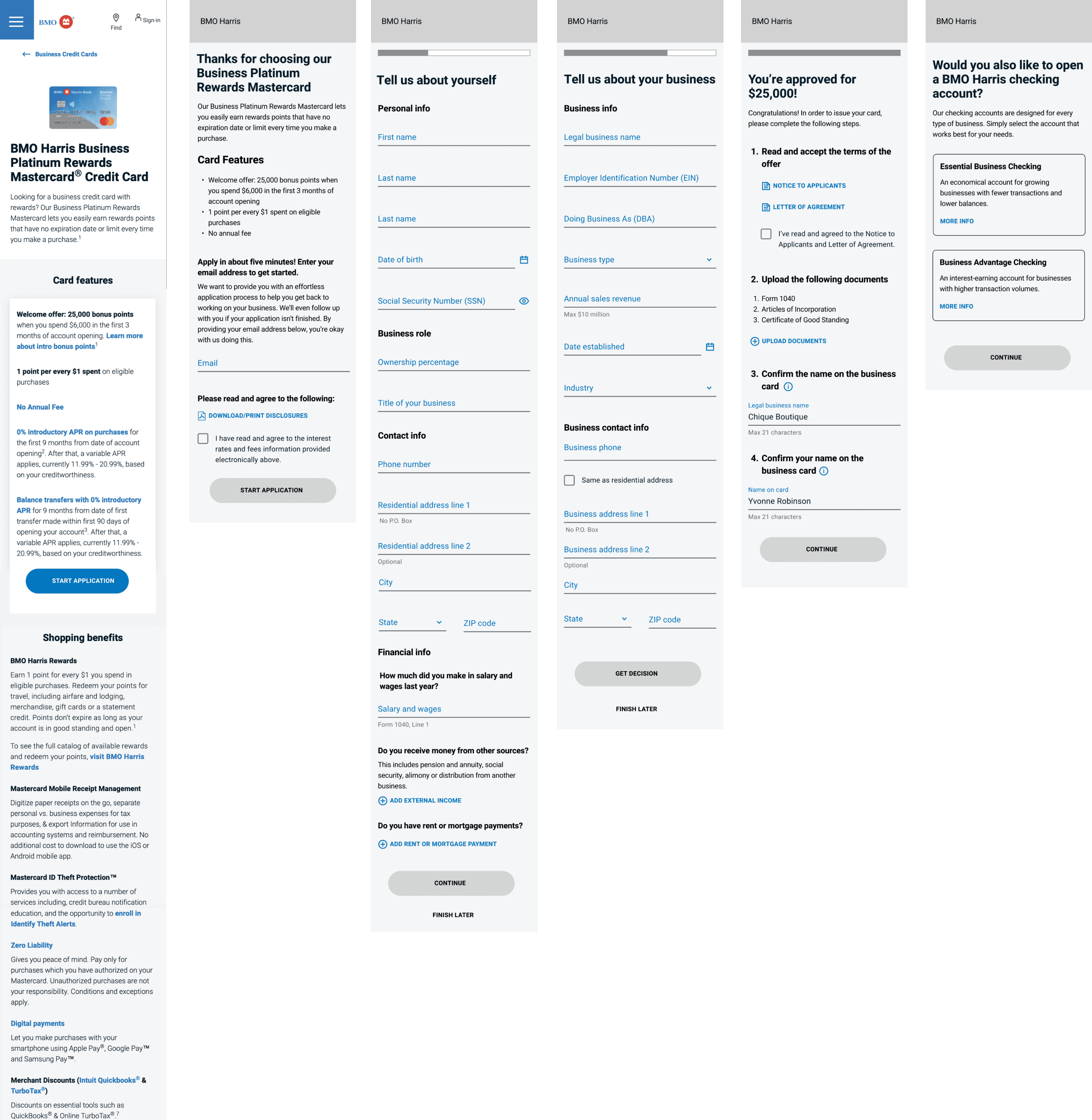

Challenges emerge

As I was designing the main screens of the flow I noticed the landing page and approval page kept accumulating content and requirements as the days and meetings went on. I thought the legal info and rates and fees attestation made it seem like we were asking a lot of the customer for only providing their email address to get started.

The approval page kept accumulating steps and I assumed most customers would drop off as soon as they knew they were approved. I started to think about moving these steps to pre-approval, but usability testing was scheduled and I didn't have time to make updates.

Usability testing

I worked with a UX researcher to test the happy path with five small business owners. Tests were remote and moderated. I attended all sessions and took notes.

Goal:

Explore small business owner expectations for a business credit card application and solicit feedback on the flow.